PocketPal and PocketMentor is dynamic duo of apps designed to foster financial literacy in children and involve parents in the process

project type

Product Design

skill

Figma | UI/UX Design

Year

2023

Role

DESIGNER

The adoption and growth of cashless and digital payments have been significant in recent years, as indicated by various global and regional statistics.

of U.S. adults now use digital payments

Traditional financial education, typically delivered through parental guidance, school programs, and hands-on experiences like handling cash, provides a foundational understanding of money management.

However, in the digital age, traditional methods may fall short in addressing the complexities of modern financial systems and lack the engagement and accessibility offered by digital tools

To meet the needs of financial literacy education for children in the digital age, digital solutions for children's financial literacy education should include the following functions:

Consumption Transactions

Task and Reward Systems

Parental Control and Participation

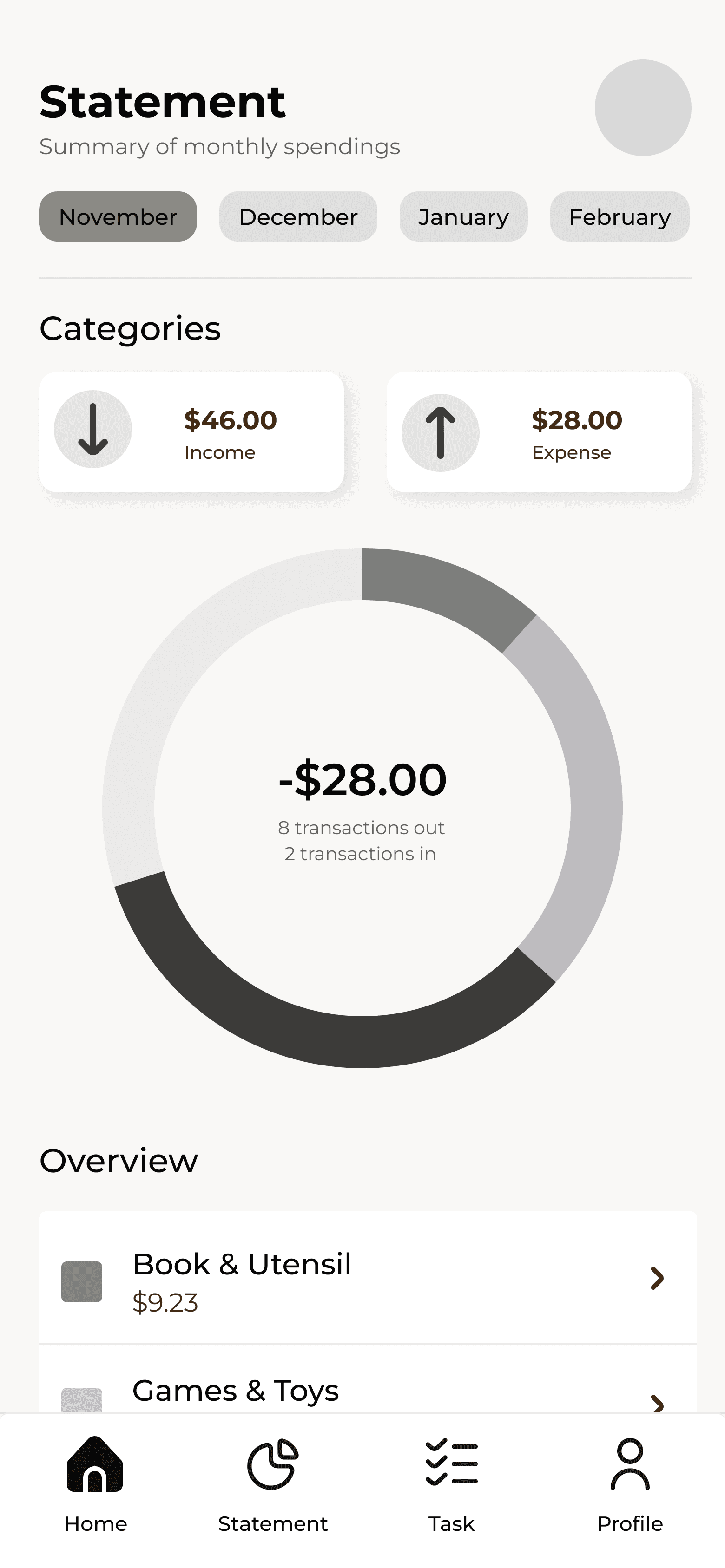

Statements and Analysis

Account Management

Budget and Savings Goals

User Research

Middle childhood kids(Ages 6 - 12) in this age group are learning how to plan ahead, budget and rely on their own inner-guidance when making decisions.

Therefore, Middle childhood kids and their parents would be the target user group.

94% of children aged between 8 and 18 years had a smartphone/watch

In many urban and developed markets, roughly 1/4-1/3 of families with school-age children now own or are considering a children’s smartwatch, driven by safety concerns and screen-time-controlled alternatives to smartphones.

Middle childhood kids(Ages 6 - 12) in this age group are learning how to plan ahead, budget and rely on their own inner-guidance when making decisions.

Therefore, Middle childhood kids and their parents would be the target user group.

Persona

Ideation

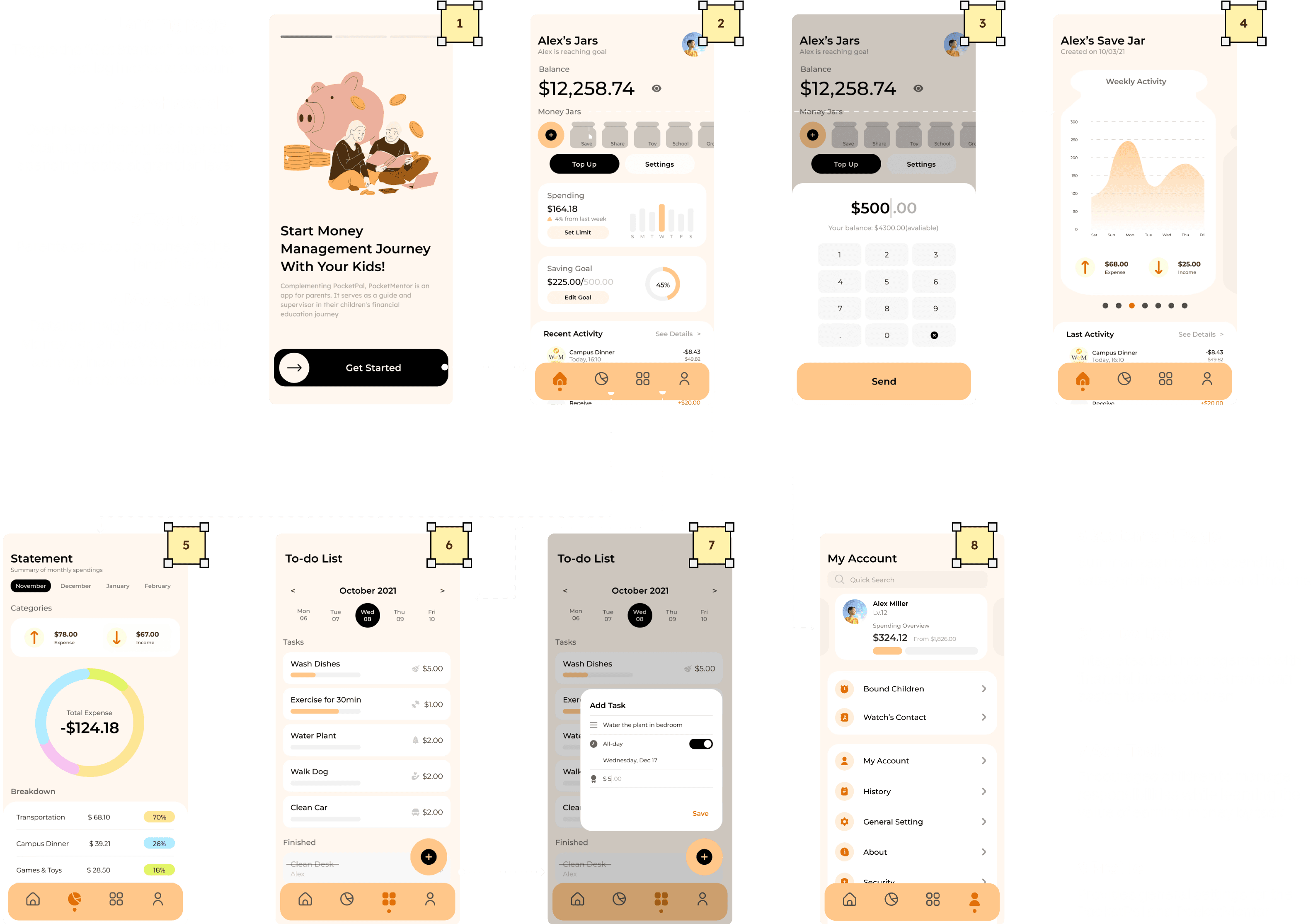

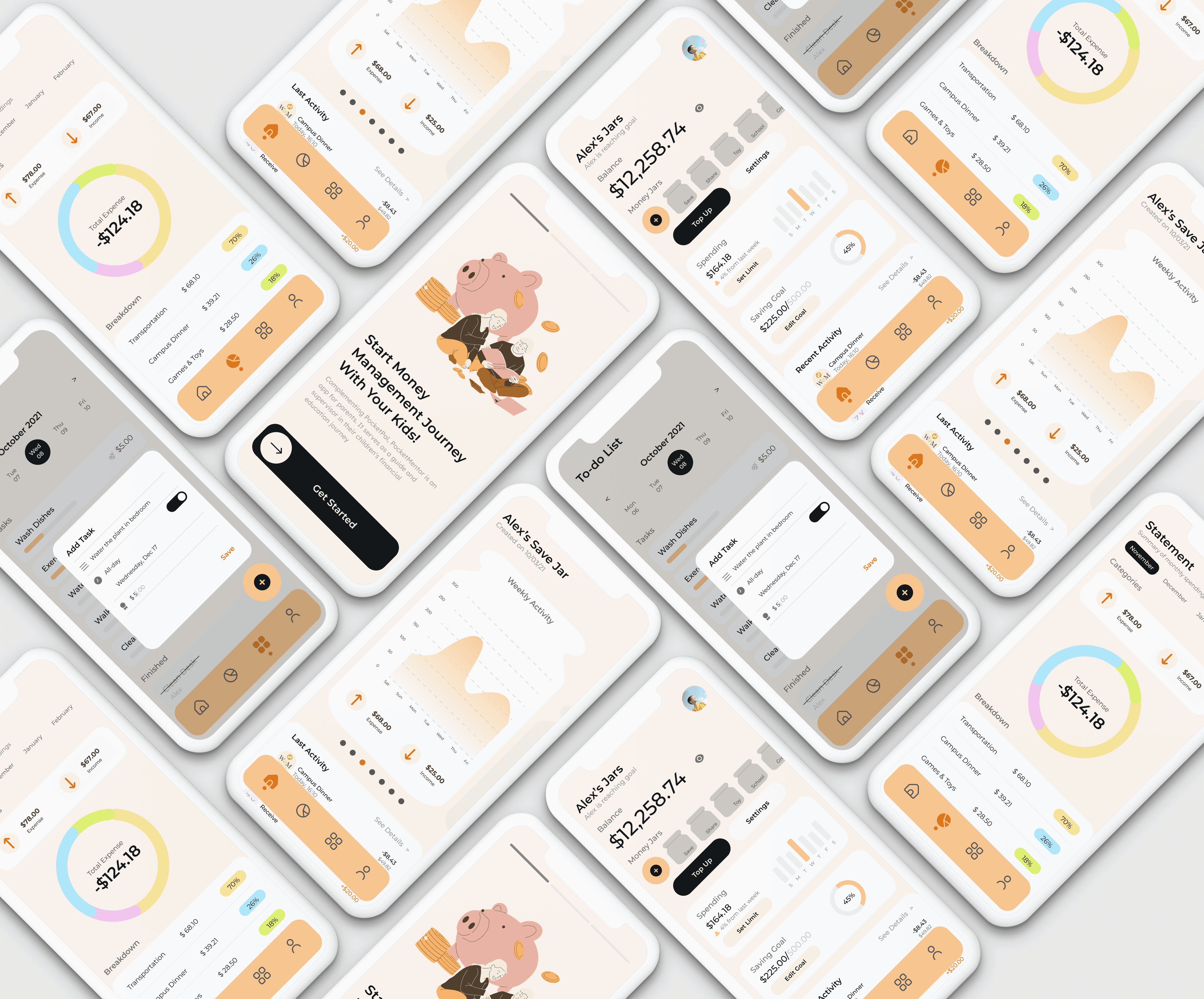

Dynamic duo of apps designed to foster financial literacy in children and involve parents in the process

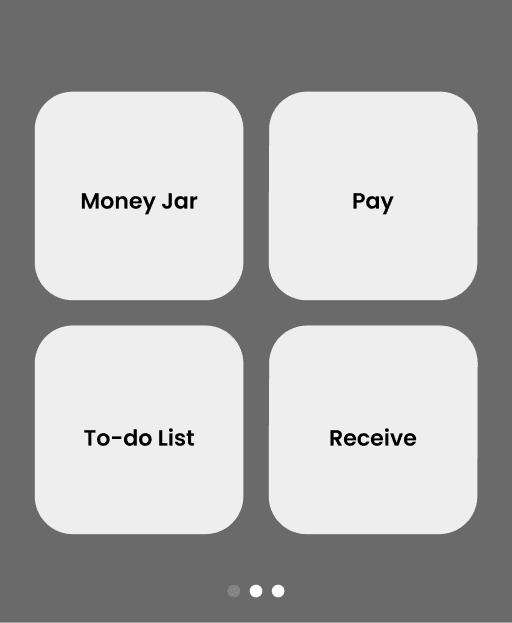

PocketPal

PocketPal is child-friendly digital wallet app for the smart watch, PocketPal turns abstract financial concepts into interactive and engaging experiences. It's tailored to help children grasp the fundamentals of money management in a digital age

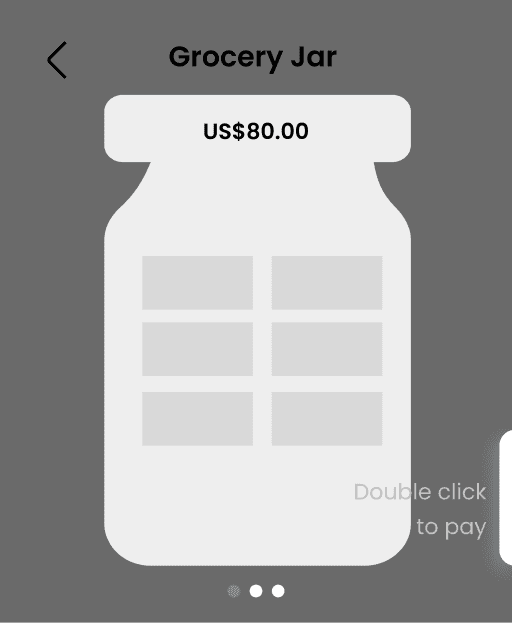

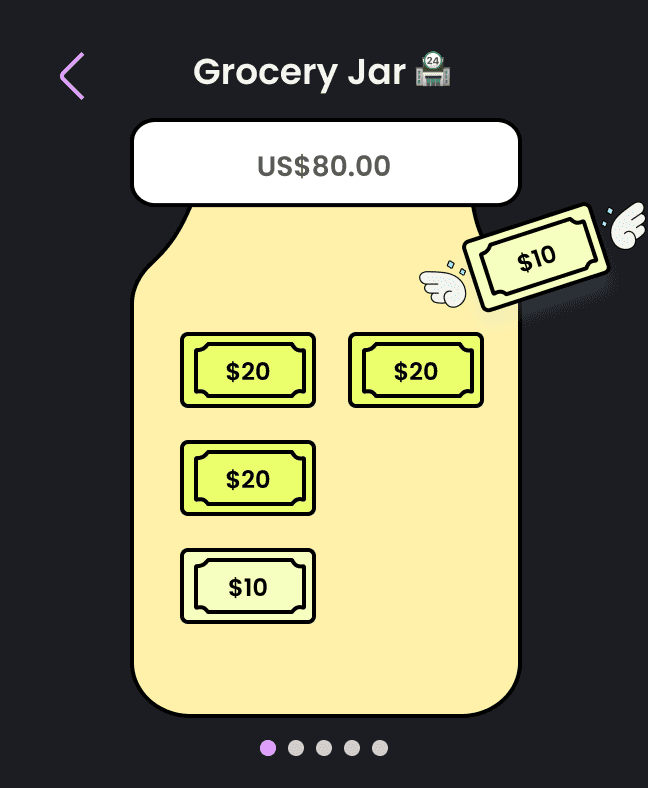

Money Jar

The Money Jar feature in PocketPal offers a customizable, visual representation of a virtual jar for users to manage their money

Users can create and personalize multiple jars to organize their savings for different goals. Additionally, the Money Jar can be set to a collaborative mode, encouraging children to work together on financial projects and develop their cooperative skills

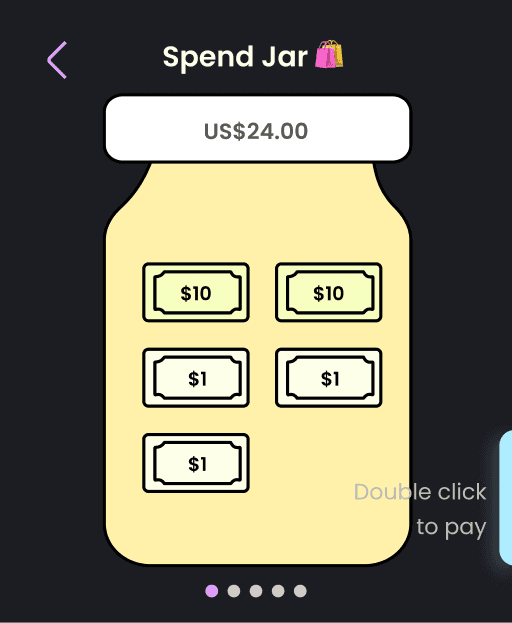

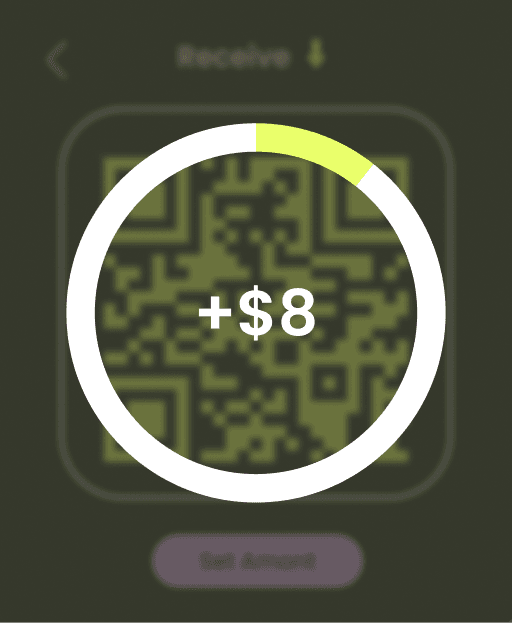

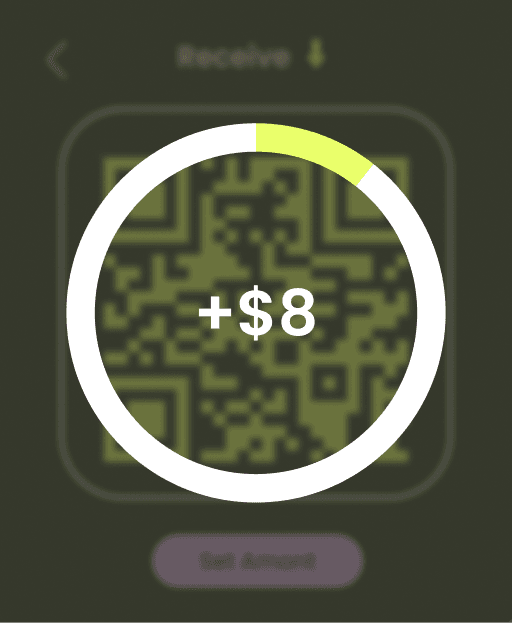

Receive & Pay

A child-friendly money system using color-coded income and expenses, QR-based payments, and animated circular progress indicators. Introduced customizable “money jars” and a double-tap payment interaction to enhance engagement and security, improving children’s understanding of money management

Receive

Receive Code

Pay

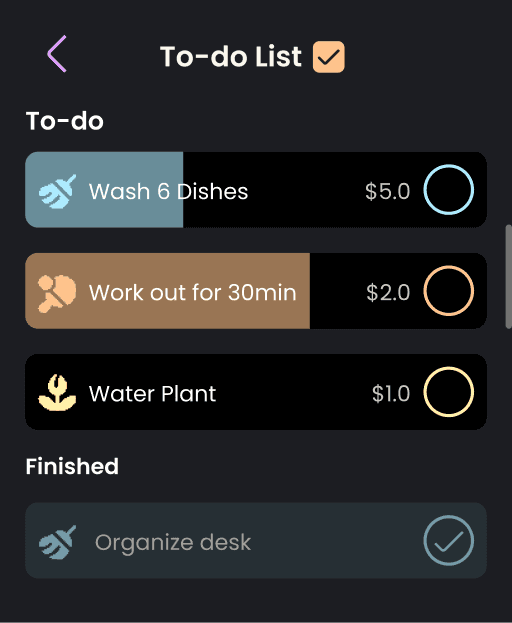

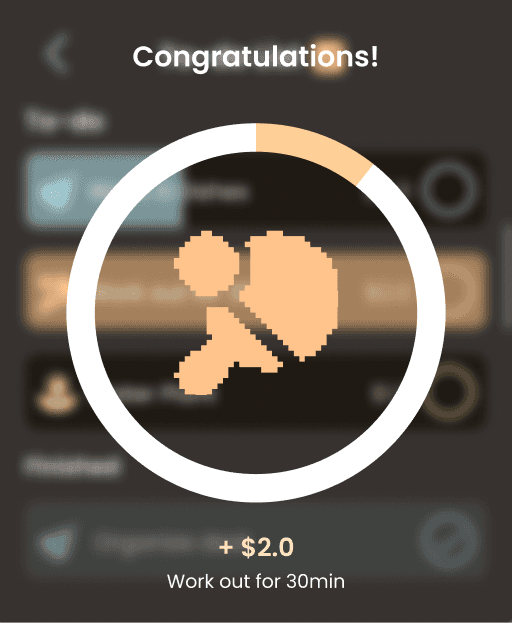

Finish Task

Finished parent-assigned tasks in PocketMentor, earned different rewards, and tracked progress as tasks were completed

To-do List

Finish Task

PocketMentor is parent-facing companion app that helps families guide children’s financial habits. Parents can assign tasks with rewards, monitor spending and saving through visual money jars, and track progress over time, turning everyday activities into structured financial learning moments